Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

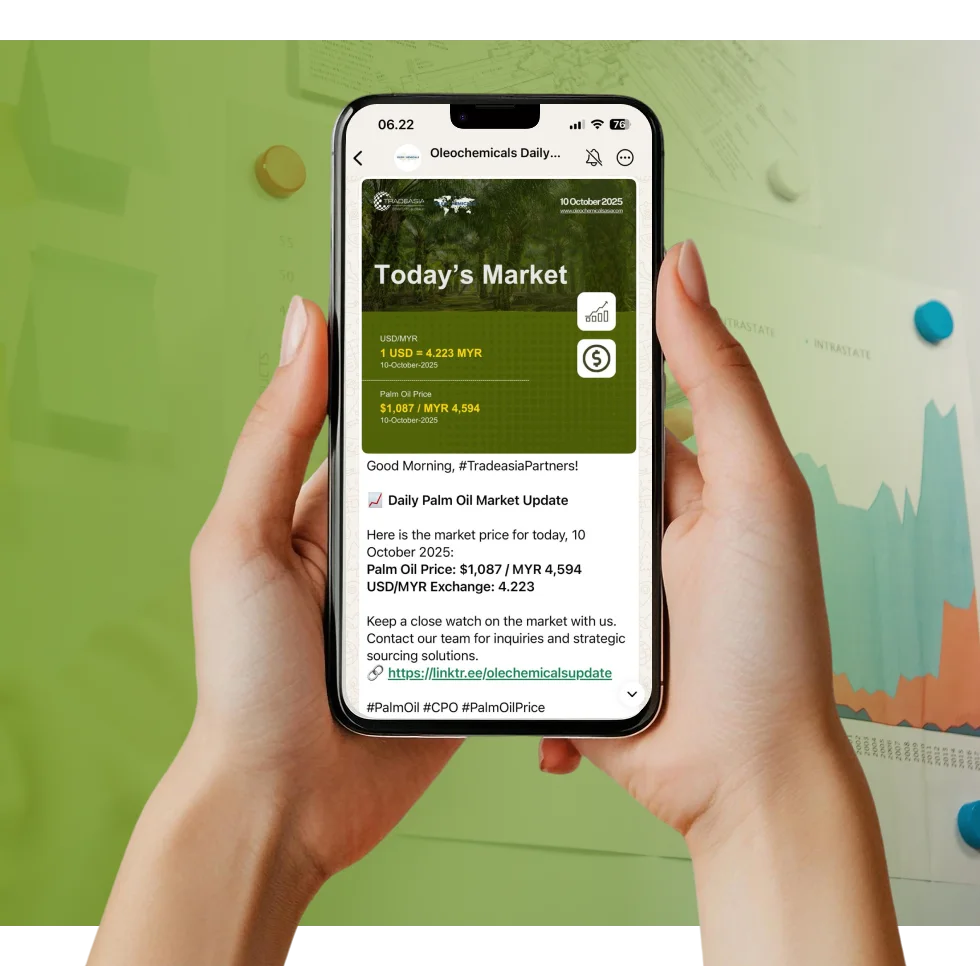

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home Stearic Acid Trade: Key Shifts 2020–2040

Article | 22 August 2025

Oleochemicals

Demand Shift: Asia and Africa are replacing Europe and North America as the primary growth hubs for stearic acid.

Volatility: Prices peaked at $1,400–$1,530 per metric ton in mid-2024, highlighting the risks of raw material shortages and logistics challenges.

Palm Oil Dependency: While palm-based feedstocks dominate production, sustainability certifications like RSPO are becoming both a market requirement and an opportunity.

Strategy for Growth: Exporters must embrace supply chain agility, sustainability, and product innovation to thrive in an increasingly complex market.

For decades, Europe and North America were the largest consumers of stearic acid, thanks to their strong personal care, automotive, and industrial sectors. But from 2020 onward, the balance has shifted. Asia and Africa have become the new growth engines, driven by rapid industrialization, expanding urban populations, and rising consumer demand. Countries such as China, India, Indonesia, and others in Southeast Asia are leading this surge, while Africa’s emerging economies are fueling additional growth in applications such as cosmetics, plastics, and rubber additives. For exporters, this shift presents a clear opportunity: repositioning supply chains closer to these dynamic regions to capture market share.

The stearic acid trade has not been immune to disruption. Supply chains have faced repeated shocks from raw material shortages, logistics challenges, and geopolitical tensions—particularly in Southeast Asia, the world’s largest palm oil hub. In 2024 and early 2025, production cuts in Indonesia and Malaysia sharply reduced palm oil output, tightening the availability of stearic acid and driving prices higher. By mid-2024, stearic acid prices in the US and Europe surged to $1,400–$1,530 per metric ton, before correcting slightly in early 2025 as logistics eased and palm oil prices softened. External factors like extreme weather, shipping bottlenecks, and labor strikes have added further volatility, forcing traders to adopt more agile strategies.

Palm oil remains the dominant raw material for stearic acid production, but it is also the sector’s greatest vulnerability. On one hand, sustainable sourcing initiatives and certifications such as RSPO open up opportunities for exporters to command premiums and meet the rising expectations of environmentally conscious buyers. On the other, reliance on palm oil means exposure to constant price volatility. This dual reality requires companies to not only secure traceable, ethical supply but also develop hedging mechanisms and diversified sourcing strategies to mitigate risk.

Global trade in stearic acid is also shaped by geopolitics. Tariffs, trade policies, and regional conflicts affect both raw material access and final product distribution. For example, Southeast Asia’s decision to increase palm oil use in biodiesel has reduced export availability, tightening the global supply of stearic acid. Port congestion and trade route disruptions further add costs and delays. Exporters that can build flexible logistics networks and diversify their routes will be better positioned to weather such disruptions.

The path forward for traders and exporters lies in balancing agility with foresight. Positioning supply chains near fast-growing Asian and African markets reduces freight costs and improves responsiveness. Investing in sustainability certifications not only ensures compliance with global regulations but also strengthens market differentiation. At the same time, data-driven inventory management and pricing models are essential to withstand raw material swings. Companies that monitor geopolitical shifts closely and diversify their supply sources will mitigate risks. Looking ahead, innovation is also key: specialized stearic acid grades, from biodegradable plastics to clean-label cosmetics, represent fast-growing downstream opportunities.

Between 2020 and 2040, the stearic acid market will be shaped by three critical forces: shifting demand toward Asia and Africa, persistent volatility in raw material supply and pricing, and the influence of global politics. Exporters and traders who embrace sustainability, adopt agile supply strategies, and focus on high-growth applications will not only survive these challenges but turn them into long-term opportunities. The ability to combine responsible sourcing, strategic positioning, and innovation will define the leaders in this evolving landscape.

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.