Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

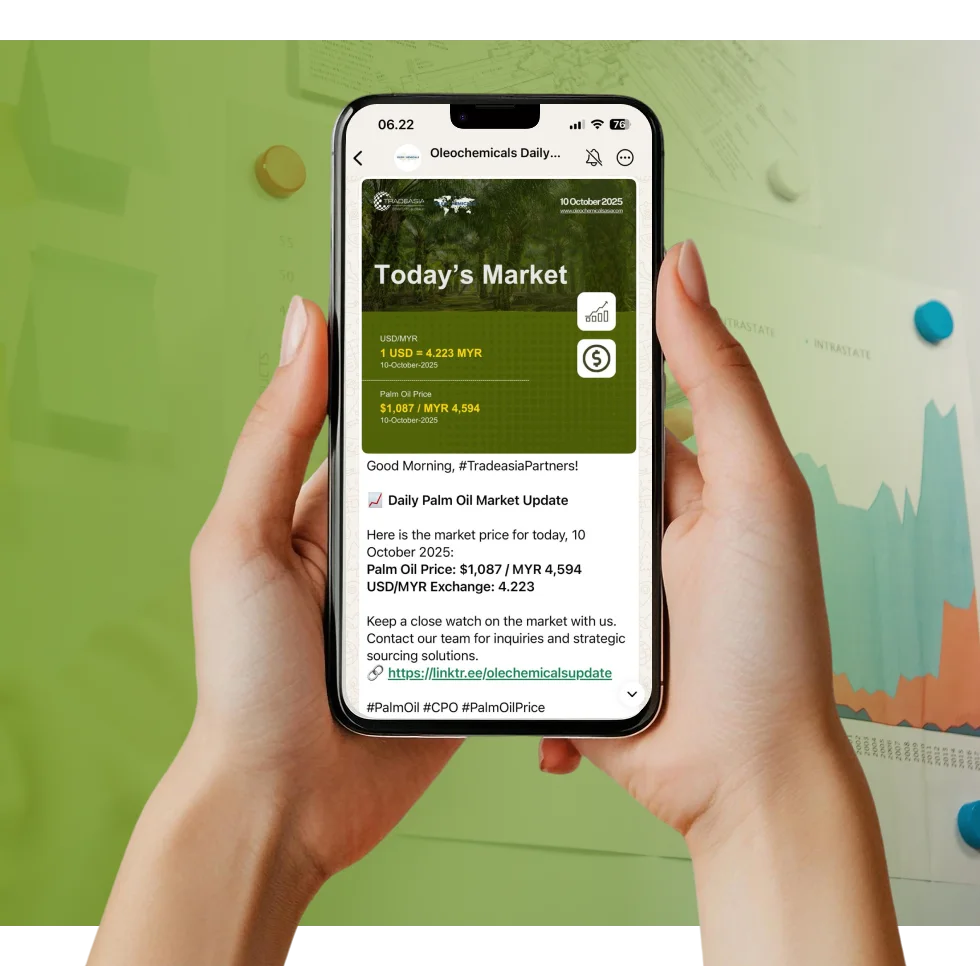

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home The APAC Pivot: Why Regional Dominance is the Key to Methyl Stearate Security

Trade Insights | Supply Chain | 01 January 2026

Oleochemicals

Industrial Diversification Amidst Scarcity

20-Year Forecast: The Platform Viability (2026–2046)

As of early January 2026, the methyl stearate market is witnessing a profound geographical realignment. Historically, Western markets relied on the bulk import of Asian feedstocks for local processing, but the rising costs of the "Regulatory Great Wall", specifically the finalized implementation of the EU Deforestation Regulation (EUDR) set for late 2026, has made this model increasingly complex. Today, the Asia-Pacific (APAC) region controls over 51% of the global market share, with production capacity in Indonesia and Malaysia expanding to capture more value-added downstream processing. This regionalization is a direct response to the feedstock squeeze; by processing methyl stearate closer to the source of the palm stearin, Asian manufacturers are minimizing the carbon footprint and logistical premiums that currently plague long-haul shipping lanes during a period of high freight volatility.

Tradeasia International excels in navigating this shifting "center of gravity." By maintaining a strong presence at the heart of the APAC production hub, Tradeasia provides industrial buyers with a bridge to the world's most vital oleochemical sources, ensuring that your supply chain remains resilient against the backdrop of global trade protectionism and logistical disruptions.

Despite the supply constraints, demand for methyl stearate remains robust in high-growth sectors. The plastics and polymers industry continues to be the largest consumer, utilizing the chemical for its superior mold-release and lubrication properties in PVC manufacturing, where the metallic stearate segment alone is projected to reach USD 5.15 billion in 2026. The pharmaceutical-grade segment is also experiencing a surge, projected to grow at a CAGR of 6.40% through 2030. Current production capacities are being tested as manufacturers in India and China ramp up their generic drug output, often willing to pay a premium for high-purity methyl esters that meet international pharmacopeia standards.

Looking toward 2046, the viability of methyl stearate as a platform chemical is secured by its role in "functional lipids." As the world moves toward sustainable agriculture, we anticipate methyl stearate being utilized as a foundational carrier for bio-pesticides and soil conditioners. Its ability to serve as a non-volatile, eco-friendly solvent will make it indispensable in the semiconductor and electronics cleaning sectors. By 2046, the integration of methyl stearate into high-tech industrial ecosystems will likely decouple its value from the fluctuations of the edible oil market, establishing it as a high-value technical commodity that thrives in carbon-neutral manufacturing environments.

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.