How can we assist you?

Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

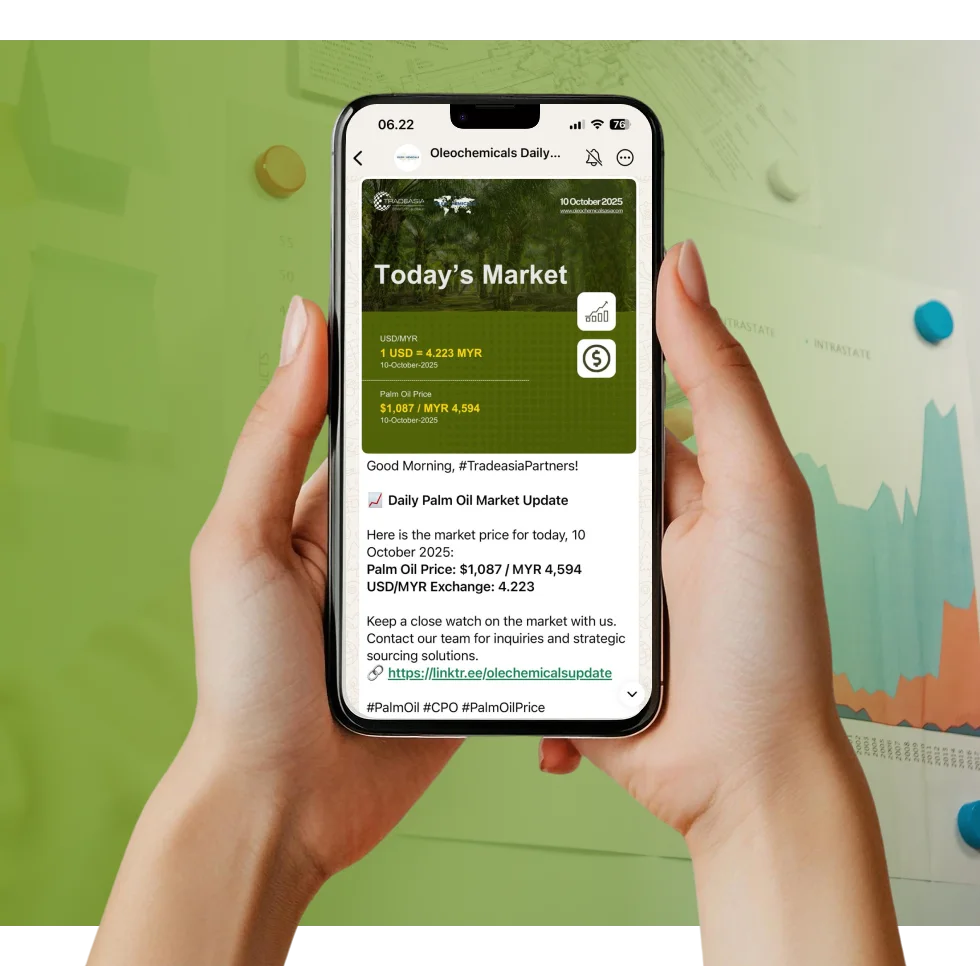

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home Mapping the Global Pivot: The Future of High-Stakes Glycerine Logistics

Trade Insights | Supply Chain | 22 December 2025

Oleochemicals

The logistics of trading crude glycerine are entering a period of unprecedented complexity. Historically, price volatility in this sector hovered around 22%, but as we move toward 2045, we expect this figure to spike to 35% due to shifting trade policies and maritime carbon taxes. To thrive in this environment, trading firms are refocusing on the Asia-Pacific "engine room," where new infrastructure—like the 55,000 MT annual capacity facility in Lampung—is coming online to satisfy the growing appetite of China and India. China’s demand alone is on a trajectory to grow by 6.5% annually, primarily to fuel its massive resins and plastics industries.

As these trade routes become more crowded, Tradeasia International stands out by offering sophisticated logistical solutions tailored to the palm and oleochemical sectors. Our ability to manage high-volume shipments while ensuring product integrity is a cornerstone of our global operations. Through a deep understanding of regional regulations and port dynamics, Tradeasia simplifies the complexities of international trade, ensuring that our partners receive their cargo on time, even as global supply chains face increasing pressure.

The physical movement of glycerine is also seeing a technical revolution, with over 70% of crude volumes now transported via 21 MT flexibags. This shift has already slashed logistics costs by 12% compared to traditional drum shipping. However, the introduction of the European Union’s Carbon Border Adjustment Mechanism (CBAM) by 2030 will introduce a "green premium," potentially adding $15 to $25 per metric ton to the cost of non-certified glycerine. This regulatory shift makes transparent, palm-based sourcing a financial imperative for European buyers.

To remain competitive through 2045, the industry must prioritize traceable, RSPO-certified supply chains. Those who can navigate these regulatory hurdles while leveraging efficient shipping methods will dominate the market, which is expected to expand from 4.78 million tons in 2025 to nearly 6 million tons by the end of this decade. Proactive supply chain mapping and the adoption of low-carbon logistics will be the primary differentiators for traders operating in the increasingly restricted global market.

Sources:

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.

How can we assist you?