How can we assist you?

Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

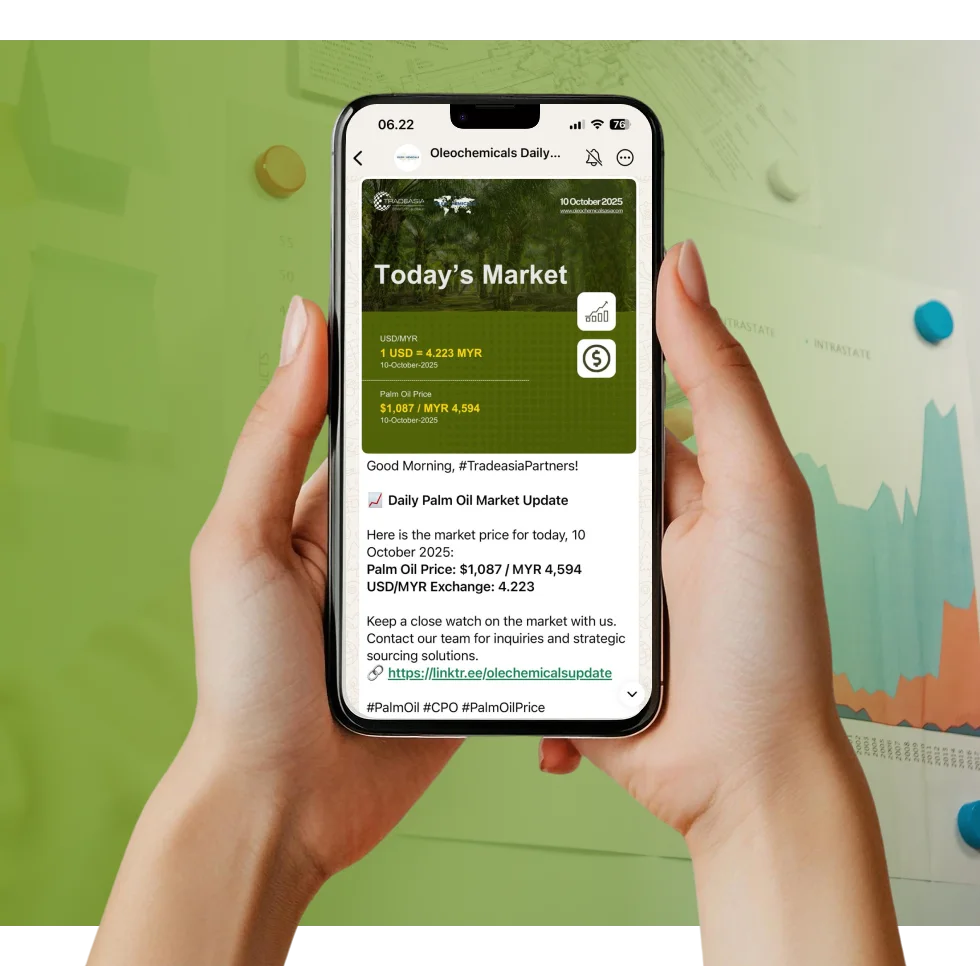

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home December Data Dive: Unpacking the 2025 Outlook for Sustainable Lauric Acid Supply Chains

Market Insight | 03 December 2025

Oleochemicals

December has traditionally been a time for reconciling the year’s commitments against actual market performance, and 2024 is no different. For those trading Lauric Acid (C12), the data decisively points toward a fortified advantage for sustainably certified supply chains as we move into 2025. This positioning is largely driven by feedstock stability. While Coconut Oil (CNO) prices experienced dramatic volatility throughout 2024—surging by over 74% Year-over-Year (YoY) due to prolonged adverse weather conditions, Palm Kernel Oil (PKO) has offered a more reliable alternative. This stability has incentivized industrial buyers to pivot toward PKO derivatives, where established sustainability standards like RSPO and ISCC are more deeply embedded and traceable.

As one of the world's leading suppliers of oleochemicals and palm derivatives, Tradeasia International understands that securing reliable, certified feedstock is the foundation of a successful trading strategy. It is, after all, "The right source, for the right future," ensuring continuity and quality for specialized demands. Looking at the supply side, the volume of RSPO-Certified PKO available for oleochemical processing saw a robust 6.5% increase in Q4 2024 compared to the previous year, reaching an estimated annual capacity of 2.8 million MT. This expansion in certified volume has not diluted the financial incentive; the premium for Certified Sustainable PKO (CSPKO) over conventional PKO held steady at an average of $110/ton in December. This data confirms that sustainability is not just a compliance cost, but a stable financial driver. Furthermore, the Asia-Pacific oleochemicals market, which dominates C12 production, is projected to accelerate its growth, with the fatty acid segment expected to see a compound annual growth rate (CAGR) of 8.1% through 2030, exceeding the global rate.

The destination market clearly dictates the need for verifiable sustainability. High-purity Lauric Acid fractions, specifically those at 98% purity and above, now constitute an estimated 47.5% of the total volume traded. These specialty grades—crucial for high-value personal care and pharmaceutical applications—demand meticulous traceability. The environmental case is equally compelling, with life-cycle assessments showing that bio-based C12 production achieves an average 8.9% reduction in CO2 emissions compared to synthesized alternatives, reinforcing its environmental case. Companies prioritizing the sourcing of certified, high-purity C12 in December are best positioned to secure lucrative Q1 2025 contracts.

Sources:

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.

How can we assist you?