How can we assist you?

Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

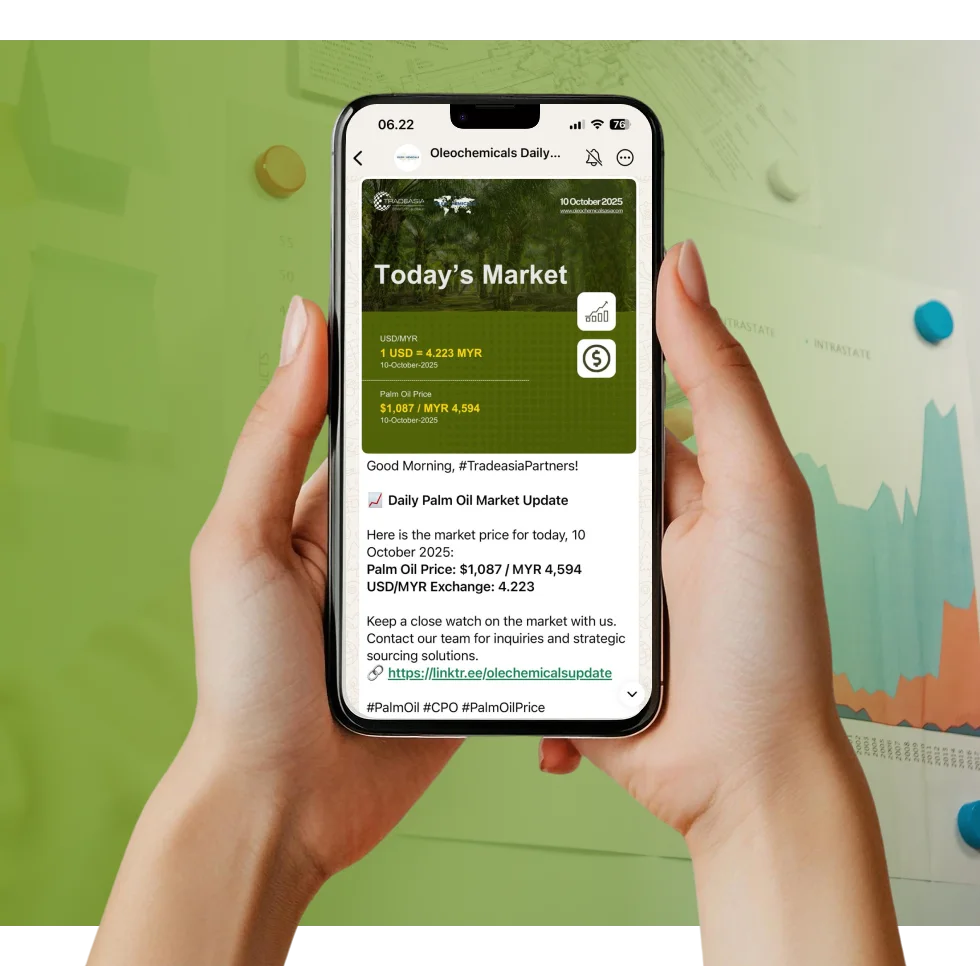

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home How 50%+ CPO Swings Create Risk and Opportunity in Stearyl Alcohol Market

Market Insight | 21 October 2025

Oleochemicals

For any procurement manager buying Stearyl Alcohol, there is one unavoidable reality: extreme price volatility. The reason? Its raw material, Palm Stearin, is a direct derivative of Crude Palm Oil (CPO), one of the world's most volatile commodities. There's a proven 0.85 to 0.90 price correlation between CPO futures and the spot price of its derivatives. Just look at 2022, when CPO prices swung wildly from over $1,800 per ton to below $900 per ton in just six months. That's not a ripple; it's a tidal wave that washes directly onto your balance sheet.

This is the kind of environment where procurement teams either win big or lose catastrophically. It’s precisely this volatility that makes a partner like Tradeasia International indispensable. We don't just sell oleochemicals; we provide the real-time market intelligence and sourcing strategies that turn that risk into a managed, strategic advantage, actively protecting our clients' margins.

This chaos is driven by a perfect storm of factors. First, unpredictable weather events like El Niño can slash palm production yields in Indonesia and Malaysia by 10-30%, creating immediate and severe supply shocks. Second, sudden government policies, like Indonesia’s Domestic Market Obligation (DMO) or abrupt export levy changes, can alter the cost basis by $50-$100 per ton overnight. Finally, you're competing with the gas tank. As our palm specialists always note, "You're not just competing with other chemical buyers; you're competing with energy." Indonesia’s B35 biodiesel mandate alone siphons over 10 million tons of CPO from the global market annually.

This environment creates massive risk, but it also creates immense opportunity. Buyers who fly blind and only purchase on the spot market will constantly be at the mercy of these swings. However, those who partner with market experts can leverage this volatility. By analyzing trends, using smart hedging strategies, and locking in favorable contract pricing during market dips, a procurement team can secure supply continuity and budget certainty. In this market, managing volatility isn't just defense; it's the best offense.

Sources:

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.

How can we assist you?