How can we assist you?

Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

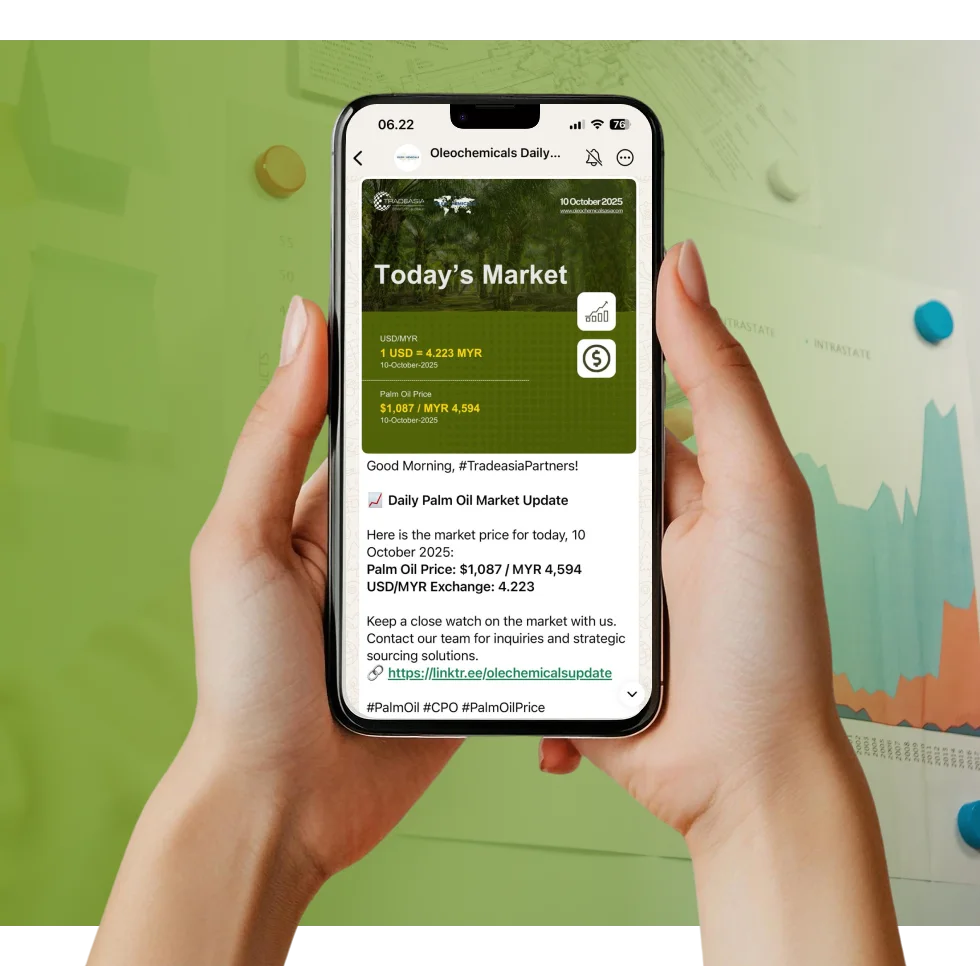

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home Beyond the Burn: Sizing the 'Hidden' High-Value Oleochemical Market for Palm Acid Oil to 2040

Market Insight | 18 November 2025

Oleochemicals

While the market story is dominated by the noisy, high-volume battle between feed and fuel, a third, more strategic usage for Palm Acid Oil is quietly gaining traction. The smartest players in the market are looking "beyond the burn." They see Palm Acid Oil not as a simple end-product to be sold, but as a crude, low-cost raw material for high-value oleochemical upgrading. This is where sustainable, long-term value is created, far from the volatility of energy prices. At Tradeasia International, our expertise isn't just in trading commodities; it's in identifying this high-value potential within the oleochemical stream and helping our partners build the supply chains to capture it.

The value proposition is rooted in chemistry. Palm Acid Oil is a rich mix of valuable fatty acids (typically ~50% Palmitic Acid and ~40% Oleic Acid) but is contaminated with glycerides and impurities. For years, most of the market sold it as-is, treating it as a low-grade byproduct. Today, however, upgrading it via distillation—a process that strips out the impurities and separates the fatty acid chains—is becoming increasingly profitable. The economics are compelling and speak for themselves: crude Palm Acid Oil trading at $700/tonne can be distilled into Palm Oil Distilled Fatty Acids (PDFA), a refined, stable product that commands prices closer to $950/tonne or more. That potential $250/tonne gross margin is a powerful, bankable incentive for investing in downstream processing.

This upgraded PDFA becomes the primary feedstock for a range of specialized, high-margin applications. The global market for biolubricants, which relies on these fatty acid esters for their superior lubricating and biodegradable properties, is projected to grow at a CAGR of 6.5% through 2035. Other critical niche uses include metallic soaps (used as essential stabilizers in the plastics industry), alkyd resins for paints, and various specialized esters. "The real strategic players," a chemical industry consultant observed, "aren't just selling their byproduct to the HVO plant. They are investing in distillation to capture a stable, high-value margin that biofuel volatility can't touch." This strategy allows them to serve the specialty chemical sector, which has more predictable demand cycles. While biofuels will undoubtedly drive volume demand for the foreseeable future, the profit champion by 2040 may very well be the oleochemical sector that chose to upgrade, not just sell.

Sources:

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.

How can we assist you?