How can we assist you?

Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

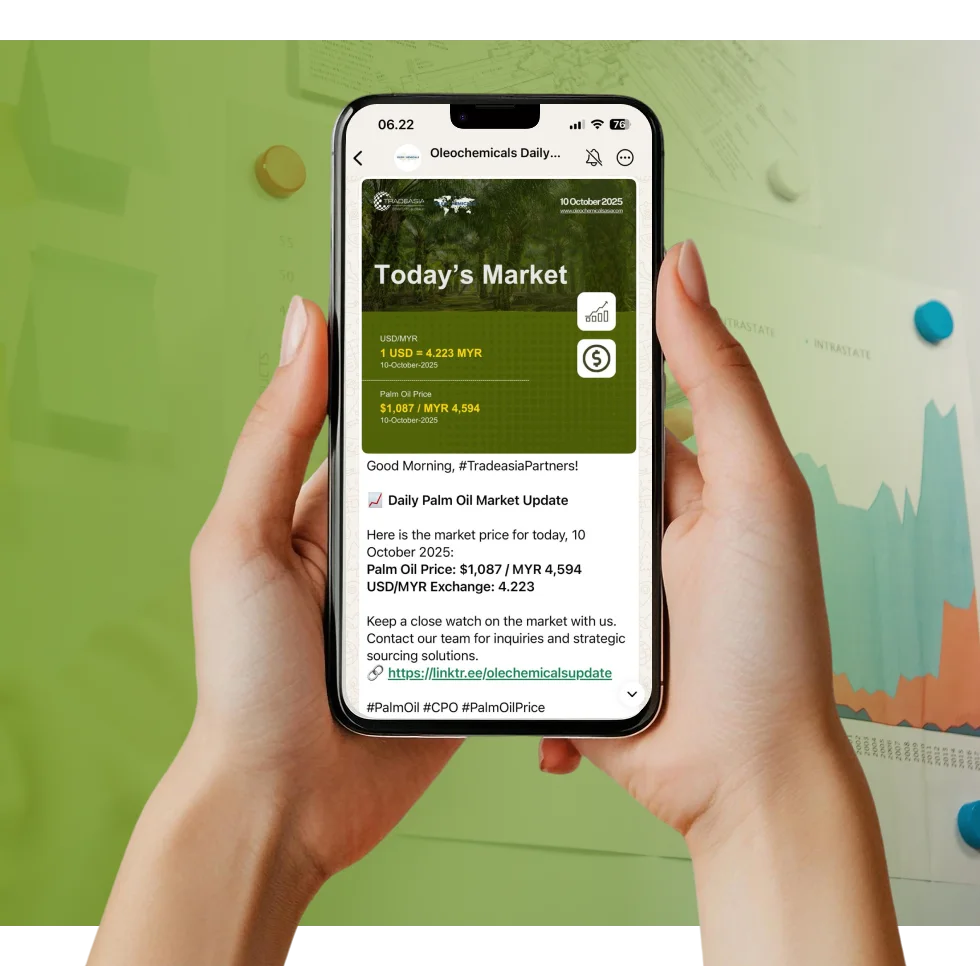

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home Navigating the EUDR: November's Regulatory Impact on Octyl Alcohol Supply Chain Resilience

Market Insight | 02 November 2025

Oleochemicals

The global trade of Octyl Alcohol has entered a new era defined by regulation, primarily the European Union Deforestation Regulation (EUDR). In November 2025, the focus for all businesses reliant on C8 fatty alcohol is the immediate need for verifiable supply chain traceability. No company can afford to bypass due diligence; the viability of their EU market access depends on ensuring their palm-derived Octyl Alcohol is demonstrably deforestation-free. The risk is immense, and the required compliance is non-negotiable.

The cost of compliance is visibly reflected in market pricing, creating a significant differential between regulated and open markets. The price data for imported Octanol (Octyl Alcohol) clearly illustrates this: the price per ton for imports into a stringent market like Germany was recorded at $6,882/ton, starkly contrasting with $3,509/ton in an open market like China. This near 100% price premium in regulated areas underscores the substantial investment required for high-level traceability and sustainability verification. "When you trade commodities, you are trading trust. The highest standards of sourcing are simply good business," a truth that underscores the value of partners who can successfully bridge this regulatory gap, ensuring consistent product quality alongside seamless documentation.

Maintaining the Octyl Alcohol supply chain's resilience requires looking beyond Europe. Global demand for palm-based biofuels, projected to grow robustly at 4.0%-5.0% annually, reinforces the industry-wide push for certified, traceable volumes. Asian manufacturers have responded strategically, with firms highlighted by Oleochemicals Asia ensuring their production lines meet the highest certification standards necessary for EU market access. This preparation is essential for protecting business continuity, particularly as countries like Indonesia face intense scrutiny over their large export volumes (2.88 million MT in March 2025). Securing C8 supply now from verified, compliant sources is the single most important action procurement teams can take this November to guarantee long-term operational stability and protect crucial market access.

Sources:

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.

How can we assist you?