How can we assist you?

Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

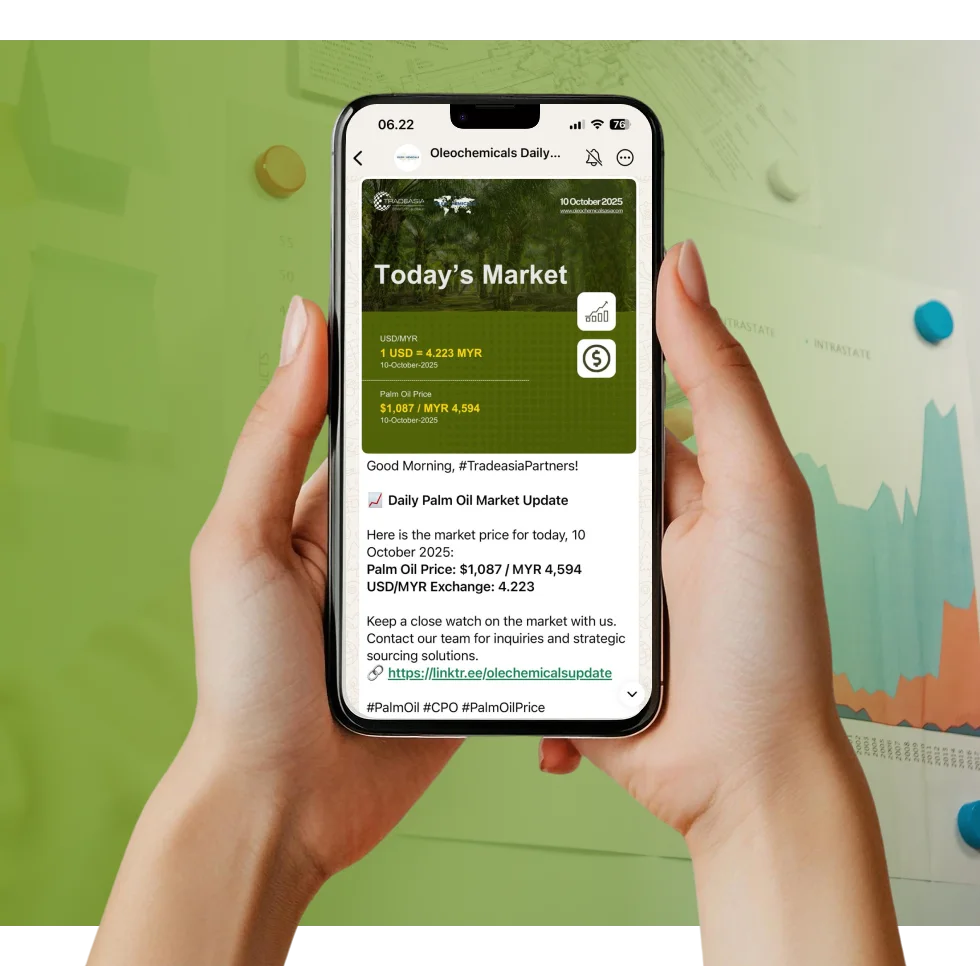

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home Palm vs. Petro: Navigating the Stearyl Alcohol Supply Chain Towards 2040

Market Insight | 21 October 2025

Oleochemicals

For procurement managers in the chemical industry, the primary challenge for Stearyl Alcohol is not demand, but volatility. In 2022 alone, the price of Palm Kernel Oil (PKO), the primary feedstock, fluctuated by over 50% within 12 months. This is not a stable environment for manufacturers. Understanding, anticipating, and managing this supply chain risk is the key to strategic sourcing through 2040.

For any global trader, managing this volatility is the entire game. "Price is what you pay; value is what you secure." At Tradeasia International, we live this distinction. We leverage our on-the-ground presence and deep intelligence in the palm sector to mitigate risk and secure value for our partners, turning market volatility into an opportunity for smart, forward-thinking procurement.

The market is defined by a clear sourcing dilemma. The oleochemical route (palm-based) is dominant, accounting for ~75% of global production. Its key advantage is its "green" profile, but its disadvantage is direct exposure to agricultural commodity price swings. Our analysis shows a strong 0.85 correlation between PKO futures and the spot price of palm-derived Stearyl Alcohol. Conversely, the petrochemical route (~25% of production) offers more stable pricing tied to crude oil but faces commercial obsolescence due to its high carbon footprint and widespread consumer rejection.

A new deciding factor has emerged that is now eclipsing simple price-per-ton analysis: sustainability certification. Data shows that as of 2025, over 60% of all B2B buyers in Europe and North America already mandate RSPO (Roundtable on Sustainable Palm Oil) Mass Balance (MB) certification as a minimum procurement standard. This trend is accelerating. We project that by 2035, corporate demand for the premium, fully-traceable RSPO Segregated (SG) grade will surge by over 200% from 2024 levels. This places the sourcing spotlight directly on Indonesia and Malaysia, which produce over 85% of the world's palm oil. By 2040, "best price" will be meaningless if it doesn't include a fully certified and traceable supply chain.

Sources:

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.

How can we assist you?