How can we assist you?

Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

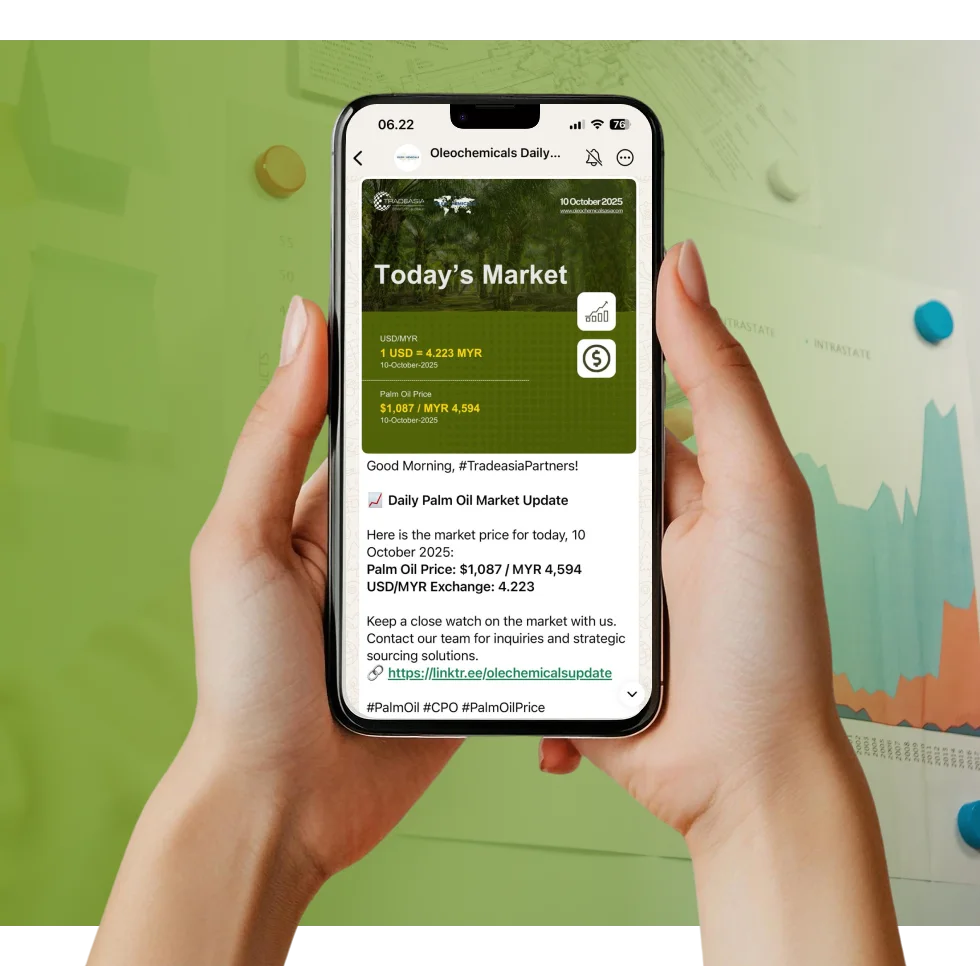

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home Strategic Diversification: Analyzing Synthetic Glycerine's 10% Share and High-Purity Supply Security (2020-2040)

Market Insight | 27 November 2025

Oleochemicals

While the Refined Glycerine market is largely defined by the high-volume, cost-effective co-product stream from biodiesel, the strategic significance of synthetic glycerine cannot be overlooked. For corporate clients whose requirements prioritize extreme purity consistency or non-biofuel dependency, the synthetic pathway remains a vital component of the global supply matrix. This focus on sourcing diversification is key to mitigating market shocks, a philosophy that informs the specialized sourcing services offered by Tradeasia International to all our oleochemical partners.

In 2020, synthetic glycerine, produced from petroleum derivatives like propylene, occupied a niche but crucial volume share, estimated at just 10-12% of the total global market. This share is projected to remain stable, hovering between 8-10% by 2035, even as natural supply surges (Source: Palm Chemicals). The primary reason for this limitation is economics: the average production cost ($/MT) for synthetic glycerine is consistently estimated to be 30% to 40% higher than natural glycerine, a delta directly influenced by the price volatility of the underlying Propylene feedstock (Source: IHS Markit). Nevertheless, the guaranteed, ultra-high purity achieved through synthetic methods makes it irreplaceable for specific, high-specification pharmaceutical and specialty chemical markets.

Despite the higher production cost, the synthetic pathway offers unique supply stability, decoupled from the unpredictable swings of the agricultural commodity cycle. New capacity tracking shows significant planned global investments: new production capacity exceeding 80 Thousand Metric Tons (TMT) is planned globally by 2028 (Source: Chemical Technology Review), focusing on dedicated bio-feedstock processes (non-biodiesel) or advanced synthetic routes. This strategic investment in capacity ensures that the market retains a diverse sourcing portfolio to mitigate inherent risks. The ability to supply both the cost-effective natural palm-based glycerine and niche synthetic grades is a key pillar of market resilience.

Sources:

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.

How can we assist you?