How can we assist you?

Explore our network of country and industry based websites to access localized information, product offerings, and business services across our group.

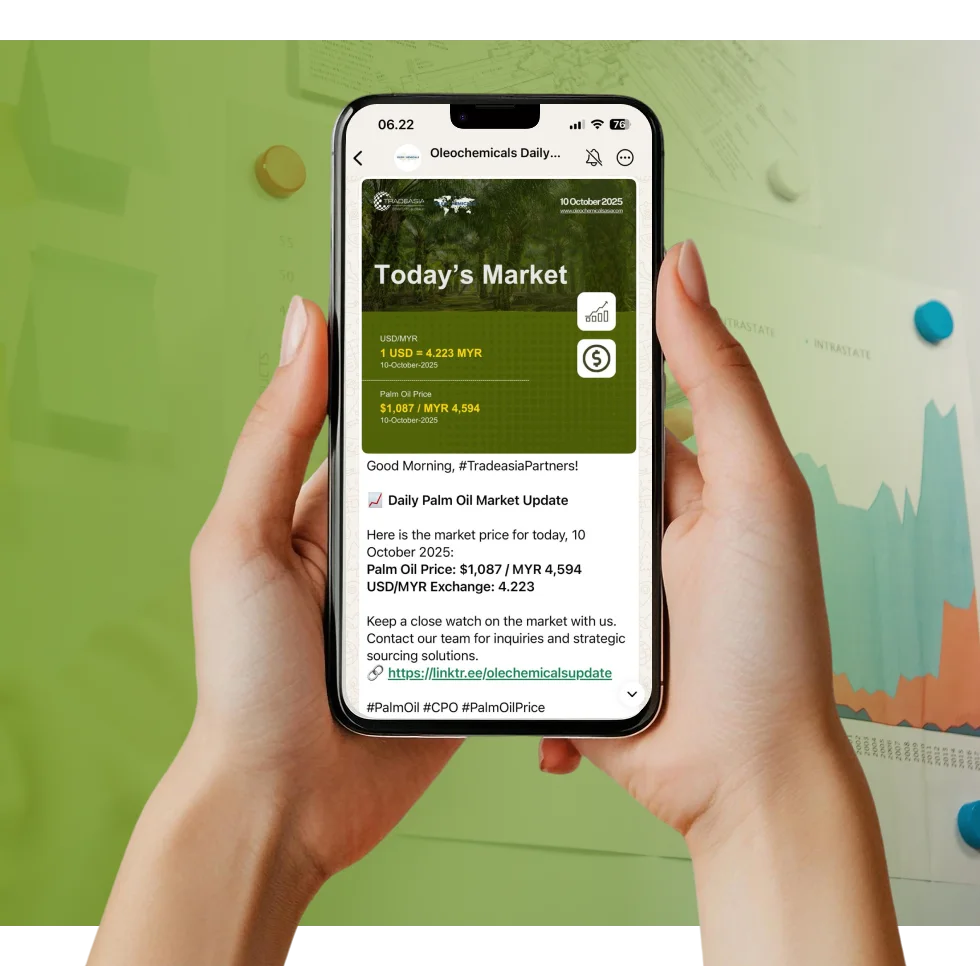

Access reliable chemical market information through our update channels.

Real-time Updates

Daily Updates

Log in to start sending quotation requests for any product.

Don't have an account? Sign Up Here

Home Why Fatty Acid Volatility is Challenging Soap Noodle Margins

Pricing Indices | 30 November 2025

Oleochemicals

The Duel for Feedstock and its Cost Implications

Market Tightness and Strategic Stockpiling

The final month of the year has proven to be a crucible for soap noodle manufacturers, with significant price volatility in key palm-based raw materials—namely Palm Fatty Acid Distillate (PFAD) and RBD Palm Stearin)—putting intense pressure on operational margins. This isn’t a standard seasonal fluctuation; it’s a dynamic interplay of competing sectors and diminishing supply, demanding a sharp focus on procurement strategies. For businesses navigating this complexity, having a reliable partner is paramount. Tradeasia International stands as a steadfast source for high-quality palm and oleochemical products, ensuring supply chain stability even when the market dictates otherwise.

The primary upward driver for PFAD prices this December is the relentless pull from the biodiesel sector, which is aggressively securing feedstock to meet mandated blending targets. As a result, PFAD export prices (FOB Southeast Asia) surged to the USD 1,045 - USD 1,075 per MT range by mid-month, marking a considerable +4.2% increase from late November’s average of USD 1,003/MT. RBD Palm Stearin, the other structural component of soap noodles, followed suit, trading near USD 1,095/MT—a +2.1% increase. This aggressive buying caused the crucial CPO-PFAD spread to narrow by 1.8% in just two weeks, a clear indicator of market tightness. This upward cost push is immediately felt downstream: considering that the fatty acid raw material constitutes about 75% of the total manufacturing cost for a standard 80:20 soap noodle blend, the 4.2% jump in PFAD directly translates to an unavoidable +3.15% increase in the overall COGS.

The supply-side data confirms this high-pressure environment. According to regional intelligence, PFAD inventory levels are estimated to be 6% lower than the five-year average for this specific December period [Source 1]. This scarcity is compounded by seasonally lower CPO production forecasts for December in Indonesia, anticipated to be down by approximately 10% due to weather and cyclical factors [Source 2]. Traders are responding by looking at January CPO futures, which trade near RM 4,050/MT, signaling expectations of continued cost elevation [Source 3]. The smart procurement move for the remainder of December is to secure volumes immediately to hedge against these escalating upstream costs and minimize the impact of the final 3.15% margin erosion.

Sources:

Southeast Asian PFAD Inventory Drops to 5-Year Low Amidst Biodiesel Mandate

Indonesian CPO Production Forecast for December 2025: Weather Impact Analysis

MDEX CPO Futures Closing Price Analysis: January 2026 Contract

Access the complete article and discover related coverage.

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.

How can we assist you?